By Mildred Reeves January 24, 2022

An eCheck is an electronic payment method through which money can be sent or received. This option is very similar to writing a check, but the transaction takes place online. This process has several advantages over other methods of conducting business transactions online.

One reason why people like using this payment system is that it allows for instant payments without having to wait for a paper check to arrive in the mail. On top of that, because there is no paper check to deal with, eChecks also sidestep the issue of having funds tied up when a check gets lost or stolen en route to its destination.

In order to use this payment system, selectors need only have an email address and a bank account number. Some eCheck processing systems even allow senders to authorize payments without having to enter their bank account information. The payment system is considered safe because all transactions are encrypted.

Another major advantage of this type of check is that it makes splitting large bills easier. This is because the sender only needs the recipient’s email address in order to initiate the transaction. For example, if someone owes three friends $75 for dinner, the money can be sent immediately to each person’s email account through an eCheck without any need of writing down each person’s bank details.

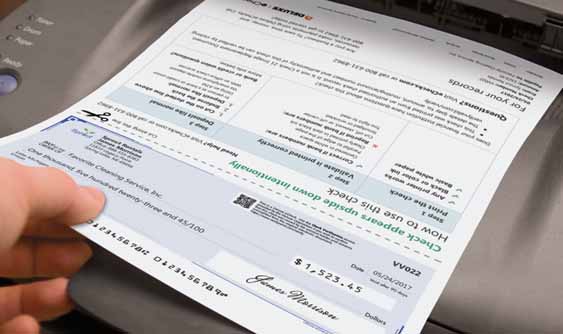

When it comes time to make a payment, there are several ways to send eChecks. The payment is initiated when the sender goes to its bank’s website and enters in some required information such as account number, amount and term. The transaction will not go through until the recipient confirms that they have received notification of the eCheck. Since this is an electronic transaction, there is no need to wait for a paper check to come in the mail. The payment will have cleared once the recipient sends a confirmation of receipt.

Some online vendors provide their customers with the option to pay via eCheck as an alternative for credit card payments, but it is important to keep in mind that this method is not available on all websites. There are some cases where a merchant may accept a check as proof of funds, but this is not considered an eCheck and will be treated as a regular paper check.

eChecks may seem like the ideal online payment method because it allows for fast and easy transactions that save time and money. However, there are some disadvantages involved with this payment system. For instance, if someone conducts a transaction through an eCheck, but later finds that they do not have the funds in their account to cover the amount of the purchase, it will be too late. This is because once a transaction has been authorized by the recipient, there is no way to stop payment from being withdrawn from the sender’s bank account.

It is also important to note that some eCheck processing systems charge fees and require a minimum amount to be sent.